Best Budgeting Tips for Young Professionals in 2025

Starting your professional life is exciting—but it also comes with serious financial responsibilities. Between rent, student loans, savings goals, and rising living costs, young professionals in 2025 face unique budgeting challenges. Fortunately, with the right strategies and tools, it’s easier than ever to take control of your money and build a strong financial foundation.

Here’s a comprehensive guide to the best budgeting tips for young professionals in 2025.

1. Start with a Clear Budgeting Goal

Budgeting is more effective when it’s tied to a purpose. Are you saving for a car, paying off student debt, or building an emergency fund?

Define your goals:

-

Short-term: Rent, groceries, transportation

-

Mid-term: Vacation, buying a new laptop, paying off debt

-

Long-term: Home ownership, investments, retirement

Having clear goals helps you stay motivated and prioritize spending.

2. Track Every Dollar with Modern Tools

Forget spreadsheets—2025 offers smarter, AI-powered budgeting tools that make money management simple.

Top budgeting apps in 2025:

-

YNAB (You Need A Budget): Excellent for goal-based budgeting.

-

Monarch Money: Ideal for couples or collaborative financial planning.

-

Emma or Copilot: AI-powered insights and automatic tracking.

These tools sync with your bank accounts and categorize spending in real time, helping you visualize where your money goes.

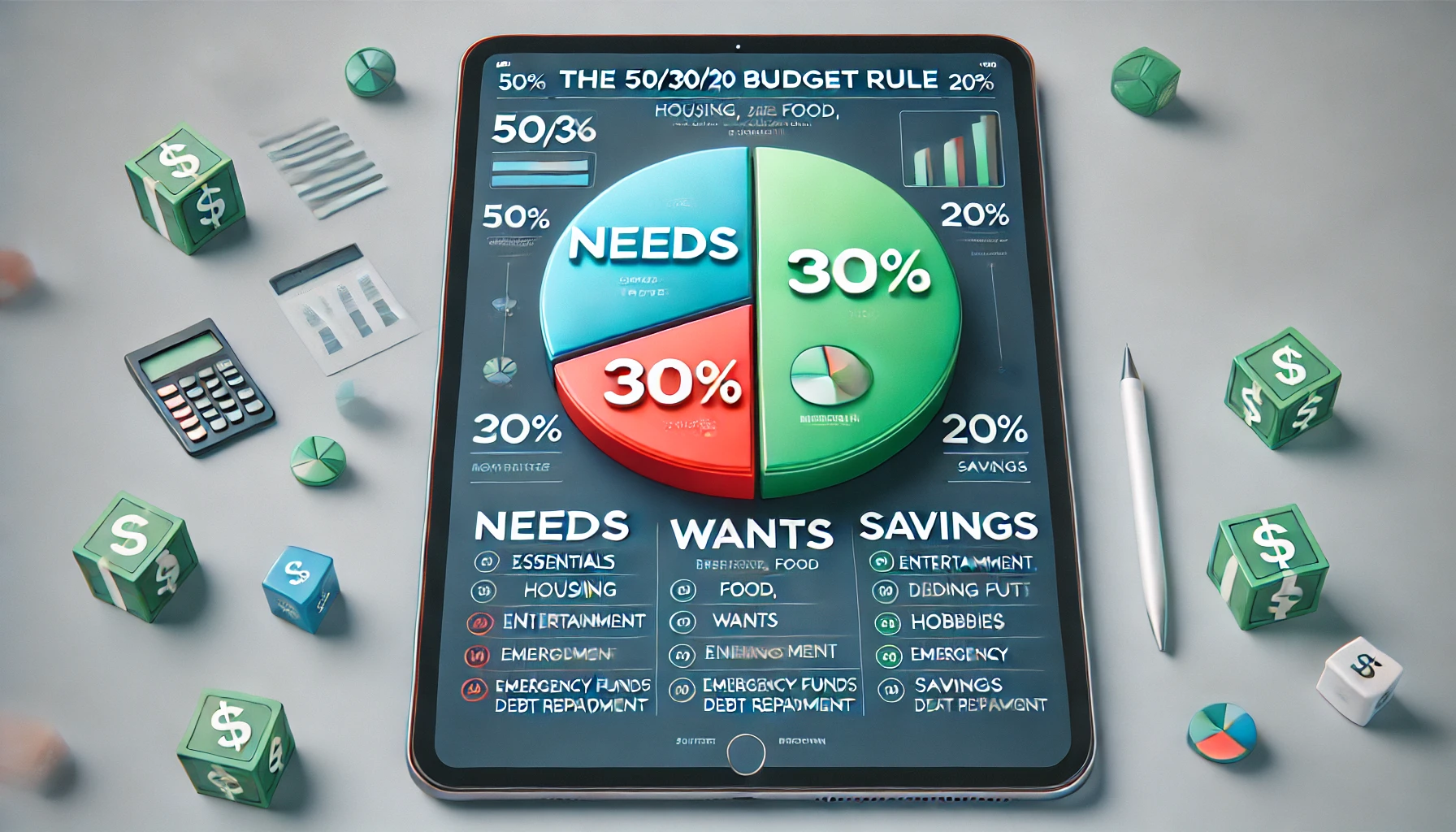

3. Use the 50/30/20 Budget Rule (with a Twist)

The 50/30/20 rule is a classic strategy that still works in 2025—with some modern tweaks.

-

50% Needs: Rent, groceries, insurance, transportation

-

30% Wants: Dining out, entertainment, hobbies

-

20% Savings/Debt Repayment: Emergency fund, investments, loans

Pro Tip: Adjust percentages based on your lifestyle or cost of living. For example, in high-cost cities, you might need 60% for needs and reduce “wants” to 20%.

4. Automate Everything

Set up automatic transfers so your savings and bills are handled without you thinking about it.

Automate:

-

Rent or mortgage payments

-

Credit card and loan payments

-

Monthly savings and investing contributions

This reduces the risk of late payments and helps grow savings passively.

5. Build an Emergency Fund First

Before investing or spending on big wants, make sure you have a safety net.

Goal: Save at least 3–6 months of essential expenses.

Where to keep it: High-yield savings accounts or digital banks with instant access and decent interest rates.

Why it matters: Unexpected expenses like medical bills, car repairs, or job loss can derail your budget fast.

6. Cut Hidden and Digital Expenses

Streaming services, subscriptions, and app renewals can eat away at your income.

Steps to manage:

-

Use apps like Rocket Money to track and cancel unused subscriptions.

-

Review monthly statements to spot recurring charges.

-

Consider bundling or downgrading services.

2025 Tip: Many banks now offer “subscription snapshots” to help manage recurring charges.

7. Make Smart Spending Decisions

Mindful spending means asking: “Do I really need this?” before tapping your card.

Tips:

-

Use a 24-hour rule for purchases over a certain amount.

-

Limit impulse buying with prepaid cards or daily spending caps.

-

Create a “fun money” account for guilt-free spending—once it's gone, it’s gone.

This helps balance enjoying life with maintaining financial discipline.

8. Increase Income, Not Just Cut Costs

Sometimes, it’s easier to grow your income than shrink your budget further.

Side hustles in 2025:

-

Freelance on platforms like Upwork or Fiverr

-

Create digital content (YouTube, Substack)

-

Sell digital products or services

-

Teach or tutor online

Increasing your income gives you more flexibility, helps pay off debt faster, and speeds up savings.

9. Learn About Smart Investing Early

Once you’ve built your emergency fund and paid down high-interest debt, it’s time to invest.

For beginners:

-

Use micro-investing apps like Acorns or Public.

-

Contribute to retirement accounts like Roth IRA or 401(k).

-

Learn basic terms: ETFs, index funds, diversification.

Start small and let compound interest work in your favor.

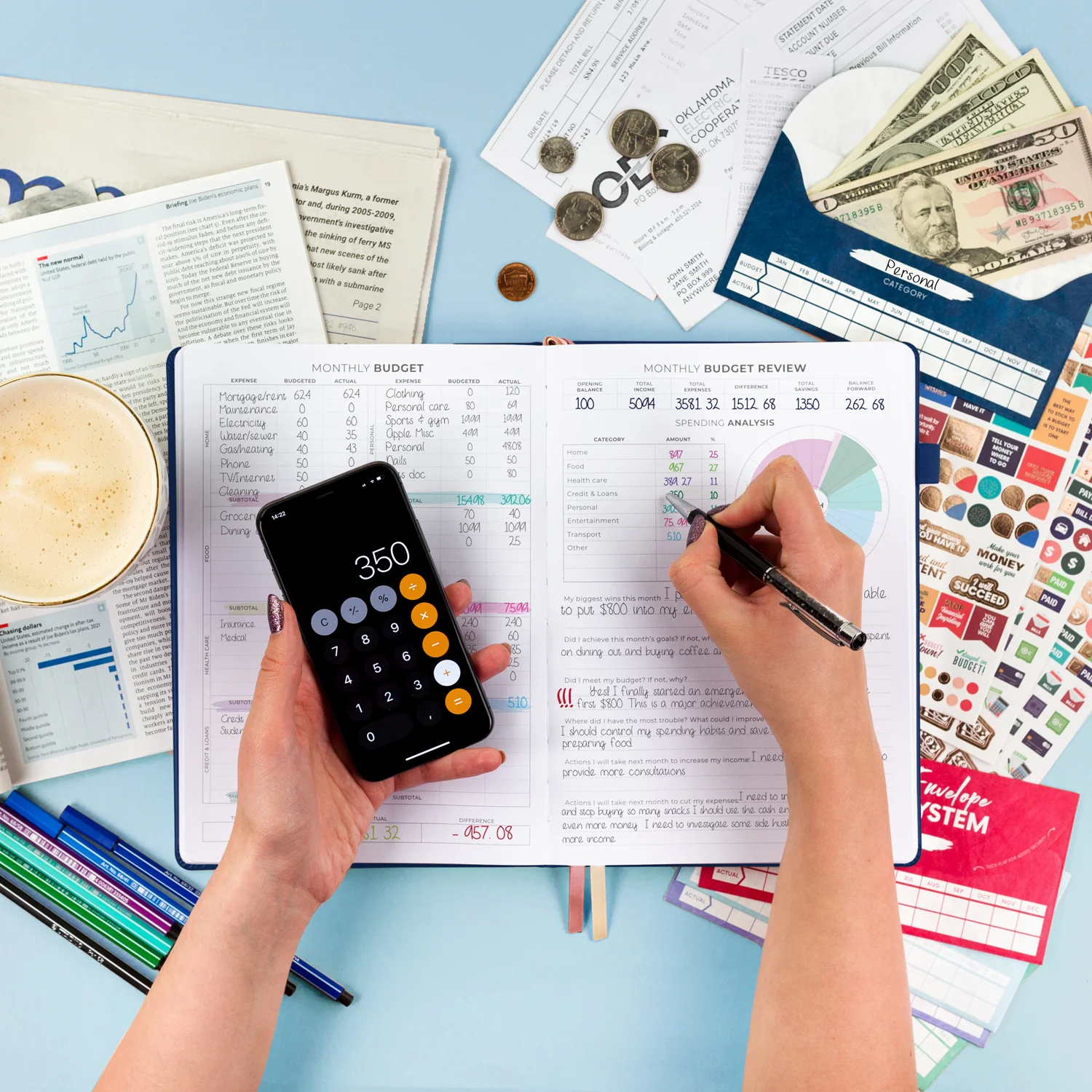

10. Review and Adjust Your Budget Monthly

Your income and expenses will change, especially in your early career. Regular check-ins help you stay on track.

Do this every month:

-

Review spending trends

-

Reassess your goals

-

Make changes to categories that aren’t working

Many apps now offer auto-adjusting budgets using AI that evolve with your financial behavior.

11. Don’t Compare Your Budget to Others

It’s tempting to compare your finances with peers on social media—but budgeting is personal. Your lifestyle, income, and goals are unique.

Stay focused on your journey. Celebrate small wins like paying off a credit card or hitting a savings milestone.

12. Take Advantage of Financial Education Tools

Financial literacy is a superpower in 2025. Free resources can help you level up.

Where to learn:

-

Podcasts (e.g., The Financial Diet, Afford Anything)

-

YouTube channels

-

Finance TikTok (just be sure to fact-check)

-

Webinars from your bank or employer

Knowledge helps you avoid costly mistakes and make smarter choices.

Final Thoughts

Budgeting in 2025 isn’t about restriction—it’s about freedom. It allows young professionals to feel in control, reduce stress, and reach their goals faster. With modern tools, mindful habits, and a bit of discipline, you can make your money work for you instead of the other way around.

Start small, be consistent, and remember: budgeting is a skill. The more you practice, the better—and richer—you get.

You must be logged in to post a comment.