How to Save & Grow Money in 2025: Beginner's Guide

In today's dynamic financial environment, establishing a robust savings and investment plan is crucial for long-term financial health. Whether you're starting your career, managing a household, or planning for retirement, understanding the fundamentals of saving and investing can set the stage for financial success.

1. Establish a Solid Budget

Creating a budget is the cornerstone of financial management. It provides clarity on income, expenses, and areas where you can optimize spending.

-

Track Your Expenses: Begin by monitoring daily expenditures to identify spending patterns. This awareness allows you to adjust habits and allocate funds more effectively.

-

Set Realistic Goals: Define short-term and long-term financial objectives. Whether it's building an emergency fund or saving for a down payment on a house, clear goals guide your budgeting decisions.

-

Utilize Budgeting Tools: Leverage apps and software that categorize expenses and provide insights into spending habits. Tools like Monarch Money and Copilot Money can assist in creating and maintaining budgets tailored to your lifestyle.

-

2. Build an Emergency Fund

An emergency fund acts as a financial safety net, offering security against unforeseen expenses like medical emergencies or urgent home repairs.

-

Determine the Ideal Amount: Aim to save 3-6 months' worth of living expenses. This range provides a buffer against most unexpected financial challenges.

-

Choose the Right Savings Vehicle: Opt for high-yield savings accounts or money market accounts that offer competitive interest rates while ensuring liquidity.

-

Automate Contributions: Set up automatic transfers to your savings account to ensure consistent growth without the temptation to spend discretionary income.

-

3. Understand Investment Basics

Investing is a powerful tool to grow wealth over time, harnessing the potential of compound interest.

-

Educate Yourself: Familiarize yourself with various investment options, including stocks, bonds, mutual funds, and real estate. Each has its risk profile and potential returns.

-

Start Small: Begin with manageable amounts, such as $100, and gradually increase contributions as you become more comfortable. This approach allows you to learn without exposing yourself to significant risk.

-

Diversify Your Portfolio: Spread your investments across different asset classes to mitigate risk. Diversification helps cushion losses in one area with gains in another.

-

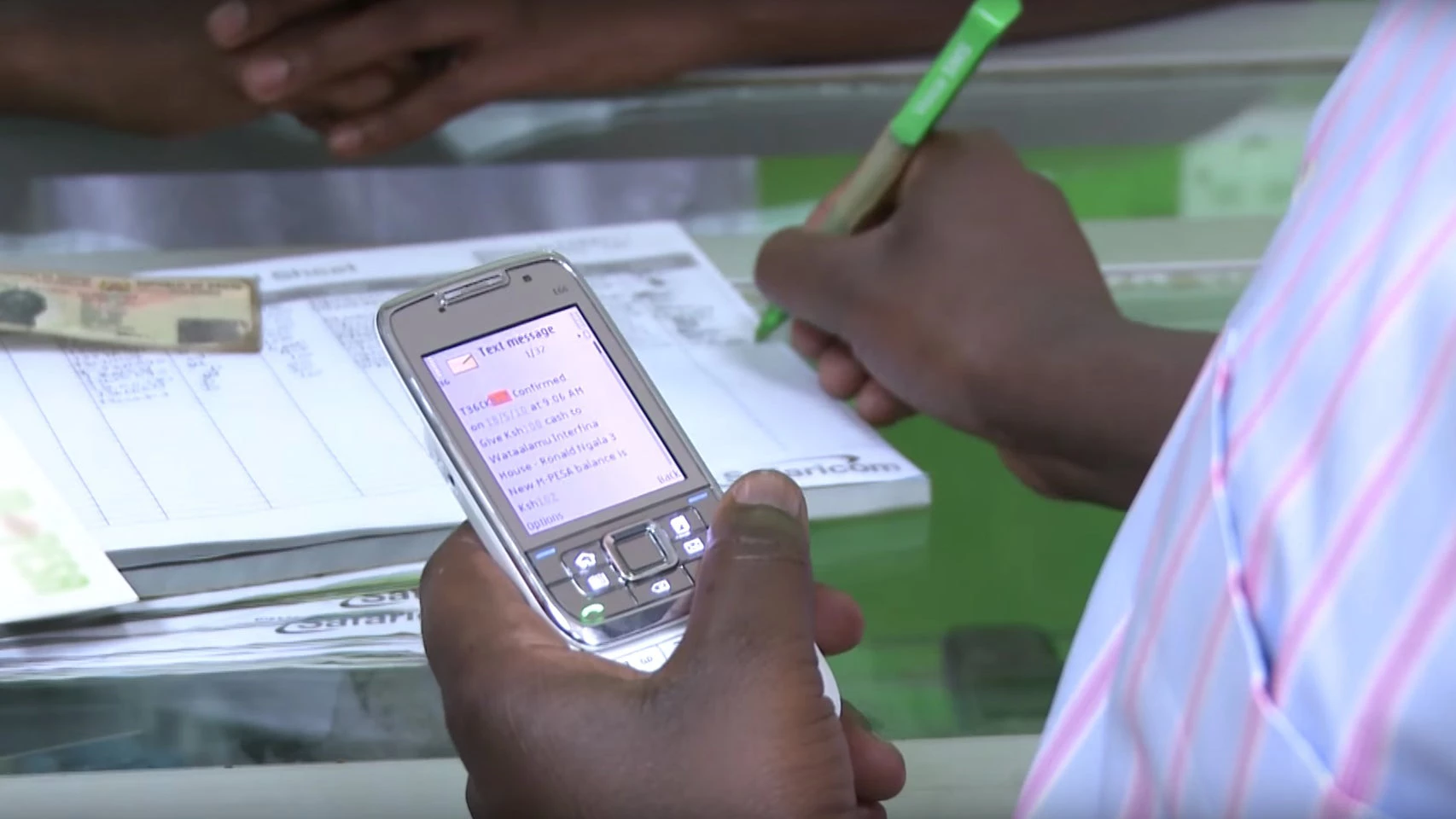

4. Leverage Technology for Financial Growth

The digital age offers numerous platforms and tools to enhance financial decision-making.

-

Robo-Advisors: These automated platforms provide investment management services, offering portfolio diversification based on your risk tolerance and goals. They often come with lower fees compared to traditional financial advisors.

-

Micro-Investing Apps: Platforms like Acorns allow you to invest spare change from daily purchases, making investing accessible without requiring substantial upfront capital.

-

Financial Literacy Resources: Utilize online courses, webinars, and articles to continuously educate yourself about financial markets, investment strategies, and economic trends.

-

5. Practice Smart Debt Management

Managing debt effectively is vital for financial stability.

-

Prioritize High-Interest Debt: Focus on paying off debts with the highest interest rates first, such as credit card balances, to reduce the overall interest paid.

-

Consider Debt Consolidation: If juggling multiple debts, explore consolidation options to streamline payments and potentially secure lower interest rates.

-

Avoid Unnecessary Debt: Before making significant purchases, assess whether they align with your financial goals and if the debt incurred is justifiable.

-

6. Stay Informed and Adaptable

The financial landscape is continually evolving, influenced by economic shifts, technological advancements, and changing regulations.

-

Regularly Review Financial Goals: Life circumstances change, and so should your financial plans. Periodically assess and adjust your goals to remain aligned with your current situation.

-

Engage with Financial Communities: Participate in forums, attend workshops, and connect with financial advisors to gain diverse perspectives and insights.

-

Embrace Continuous Learning: The more informed you are, the better equipped you'll be to make sound financial decisions. Stay updated on financial news, investment trends, and economic indicators.

-

7. Consider Retirement Planning Early

It's never too early to start planning for retirement. The earlier you begin, the more you benefit from compound growth.

-

Understand Retirement Accounts: Familiarize yourself with options like 401(k)s, IRAs, and Roth IRAs. Each has unique benefits and contribution limits.

-

Take Advantage of Employer Matches: If your employer offers a matching contribution to retirement plans, ensure you're contributing enough to maximize this benefit.

-

Regularly Increase Contributions: As your income grows, consider increasing your retirement contributions. This habit ensures you're consistently building your retirement nest egg.

-

8. Cultivate a Wealth-Building Mindset

Your approach to money significantly impacts your financial journey.

-

Set Clear Financial Goals: Define what you aim to achieve financially, whether it's purchasing a home, traveling the world, or achieving financial independence.

-

Develop Healthy Financial Habits: Regularly saving, avoiding impulse purchases, and living within or below your means are foundational habits for wealth building.

-

Seek Professional Guidance: Consulting with financial advisors can provide personalized strategies and insights tailored to your financial situation and goals.

-

Conclusion

Embarking on the path to financial security in 2025 requires a combination of disciplined saving, informed investing, and continuous learning. By implementing these strategies and remaining adaptable to changing financial landscapes, beginners can build a strong foundation for a prosperous financial future. Remember, the journey is a marathon, not a sprint; consistency, education, and proactive planning are your allies along the way.

You must be logged in to post a comment.