In today's fast-paced world, a good credit score is essential for unlocking numerous financial opportunities. Whether you're applying for a loan, renting a flat, or even securing employment, your creditworthiness is often assessed based on your credit score. If you find yourself struggling with a less-than-stellar credit history, don't despair. This comprehensive guide will provide you with actionable steps to improve your credit score, empowering you to take control of your financial future.

Understand the Basics of Credit Scores:

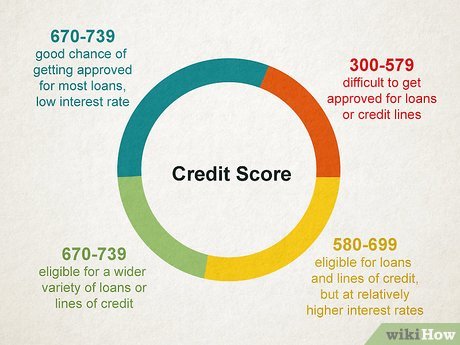

To embark on your credit score improvement journey, it's crucial to understand the fundamentals. A credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. Several factors contribute to your score, including payment history, credit utilization, length of credit history, credit mix, and new credit inquiries. By comprehending these components, you can identify areas that need improvement and devise a strategy accordingly.

Review Your Credit Reports:

The first step toward credit score improvement is to obtain copies of your credit reports from major credit bureaus. Examine each report carefully, ensuring that the information is accurate and up to date. Look out for errors, such as incorrect personal information or accounts that don't belong to you. If you identify any discrepancies, promptly dispute them with the credit bureaus to have them rectified. Accurate credit reports lay the foundation for an effective credit improvement plan.

Establish a Payment Routine:

One of the most significant factors influencing your credit score is your payment history. Consistently paying your bills on time demonstrates financial responsibility and positively impacts your score. Set up automatic payments or reminders to ensure you never miss a due date. If you have past due accounts, work on bringing them current as quickly as possible. Remember, even one late payment can have adverse effects on your creditworthiness, so prioritize timely payments.

Reduce Credit Utilization:

Credit utilization refers to the percentage of your available credit that you're currently using. Aim to keep this ratio below 30% to demonstrate responsible credit management. If your utilization is high, develop a plan to pay down existing balances. Consider strategies such as paying off high-interest debt first or consolidating balances with a personal loan. By reducing your credit utilization, you can significantly improve your credit score over time.

Build a Positive Credit History:

Length of credit history plays a role in determining your creditworthiness. If you have limited credit history, take steps to establish new credit accounts responsibly. This can be achieved through secured credit cards or becoming an authorized user on someone else's account. Use your credit responsibly by making small purchases and promptly paying off the balances each month. Over time, this will help you build a positive credit history, bolstering your credit score.

Be Cautious with New Credit Application:

When you apply for new credit, lenders pull your credit report, resulting in a hard inquiry. Multiple hard inquiries in a short period can negatively impact your credit score. Therefore, be selective when applying for new credit. Only do so when necessary and ensure that you're likely to be approved. Instead of multiple applications, consider shopping around within a short timeframe to find the best terms and rates while minimizing the impact on your credit score.

Improving your credit score is a journey that requires patience, persistence, and responsible financial habits. By understanding the factors that influence your credit score and taking proactive steps to address them, you can steadily enhance your creditworthiness. Remember, there are no quick fixes, but with consistent effort, you can unlock a world of financial opportunities and pave the way.

You must be logged in to post a comment.