Table of Contents

- Introduction: The Government's Consideration of an Extraction Obligation

- The Rationale Behind the Proposal

- Potential Economic and Industry Impacts

- Implications for Consumers and Pricing

- Alternative Strategies to Address the Revenue Deficit

1. Introduction: The Government's Consideration of an Extraction Obligation

The government is reportedly exploring the implementation of a sugar extraction obligation as a means to tackle the growing revenue deficit. This proposal aims to impose regulatory requirements on sugar producers, possibly mandating the extraction of sugar for ethanol or other government-directed uses. While this initiative is still under discussion, stakeholders in the sugar industry, including farmers, manufacturers, and consumers, are closely monitoring its potential implications.

The idea of an extraction obligation is not new. Many countries have used similar policies to regulate the sugar sector and increase revenue generation. However, implementing such a measure requires careful consideration to ensure that it does not adversely affect local industries or create additional financial burdens on consumers.

2. The Rationale Behind the Proposal

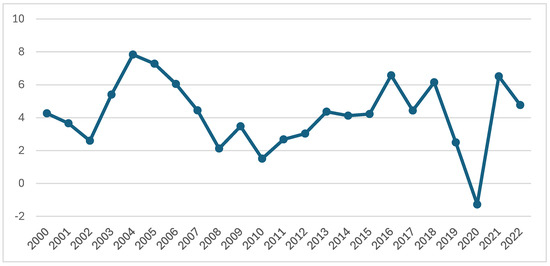

The primary motivation behind the proposed extraction obligation is the government’s need to address the widening revenue deficit. With fluctuating global sugar prices and domestic market challenges, policymakers see this as an opportunity to generate additional tax revenue.

Key reasons for considering this obligation include:

- Revenue Generation: The government could collect additional taxes or levies from sugar processing and extraction.

- Regulatory Control: Implementing such a measure could help regulate the sugar supply chain, preventing overproduction or market manipulation.

- Support for Alternative Energy Sources: If sugar extraction is directed towards ethanol production, it could boost the biofuel sector, reducing dependency on imported fuels.

Despite these potential benefits, industry experts warn that such an obligation could have unintended consequences, particularly for sugar producers and consumers.

3. Potential Economic and Industry Impacts

Introducing a mandatory extraction obligation on sugar could have both positive and negative effects on the economy and the sugar industry.

Positive Impacts:

- Increased government revenue through taxation and regulation.

- Enhanced ethanol production, leading to reduced fuel import costs.

- Greater oversight of the sugar industry, reducing illegal market practices.

Negative Impacts:

- Increased production costs for sugar manufacturers.

- Potential supply shortages, leading to higher consumer prices.

- Possible disruption in sugar exports, affecting foreign exchange earnings.

Balancing these factors will be critical for the government as it considers implementing this measure. Industry leaders have already raised concerns about the economic feasibility of such an obligation.

4. Implications for Consumers and Pricing

One of the most significant concerns surrounding this proposal is its impact on sugar prices and availability for consumers. If manufacturers are required to extract a portion of their sugar for government-directed purposes, it could lead to:

- Reduced Supply: Less sugar available for domestic consumption, pushing up prices.

- Higher Costs: Increased production costs could be passed on to consumers.

- Market Volatility: Potential fluctuations in sugar prices due to regulatory changes.

Governments in other countries that have implemented similar policies have often had to introduce price controls or subsidies to prevent excessive cost increases for consumers. Whether such measures will be considered in this case remains uncertain.

5. Alternative Strategies to Address the Revenue Deficit

While the extraction obligation on sugar is being considered, there are alternative strategies the government could explore to bridge the revenue deficit:

- Expanding the Tax Base: Implementing broader tax reforms to increase revenue without targeting specific industries.

- Public-Private Partnerships: Encouraging investment in industries that contribute to economic growth and tax revenue.

- Reducing Tax Evasion: Strengthening tax collection measures to ensure compliance across sectors.

- Diversifying Exports: Promoting exports in other agricultural or manufacturing sectors to generate foreign exchange earnings.

The decision to impose a sugar extraction obligation should be carefully weighed against these alternative strategies to determine the most effective approach to addressing the revenue deficit without causing undue strain on the economy.

You must be logged in to post a comment.